Unlock

Your Potential

Ballad provides industry-responsive and innovative skills and employability training for Canadians so that they can obtain meaningful employment in their desired career pathway. Our aim is to support and empower our participants to build a resilient and thriving livelihood. We work with industry to design programs that respond to the future workforce needs and the rapidly changing labour market.

Visions

Become Reality

We co-design solutions to support thriving and prosperous businesses and communities that are empowered to pursue their long-term vision. We collaborate with government, Indigenous Communities and the private sector to provide economic development, community development and business advisory services across Canada.

Workforce Development & Consulting Services In Alberta

Ballad’s purpose is to positively impact and empower our program participants and clients across Canada. Our approach is grounded in mutual trust and respect and is aligned with our values of accountability, collaboration and entrepreneurship.

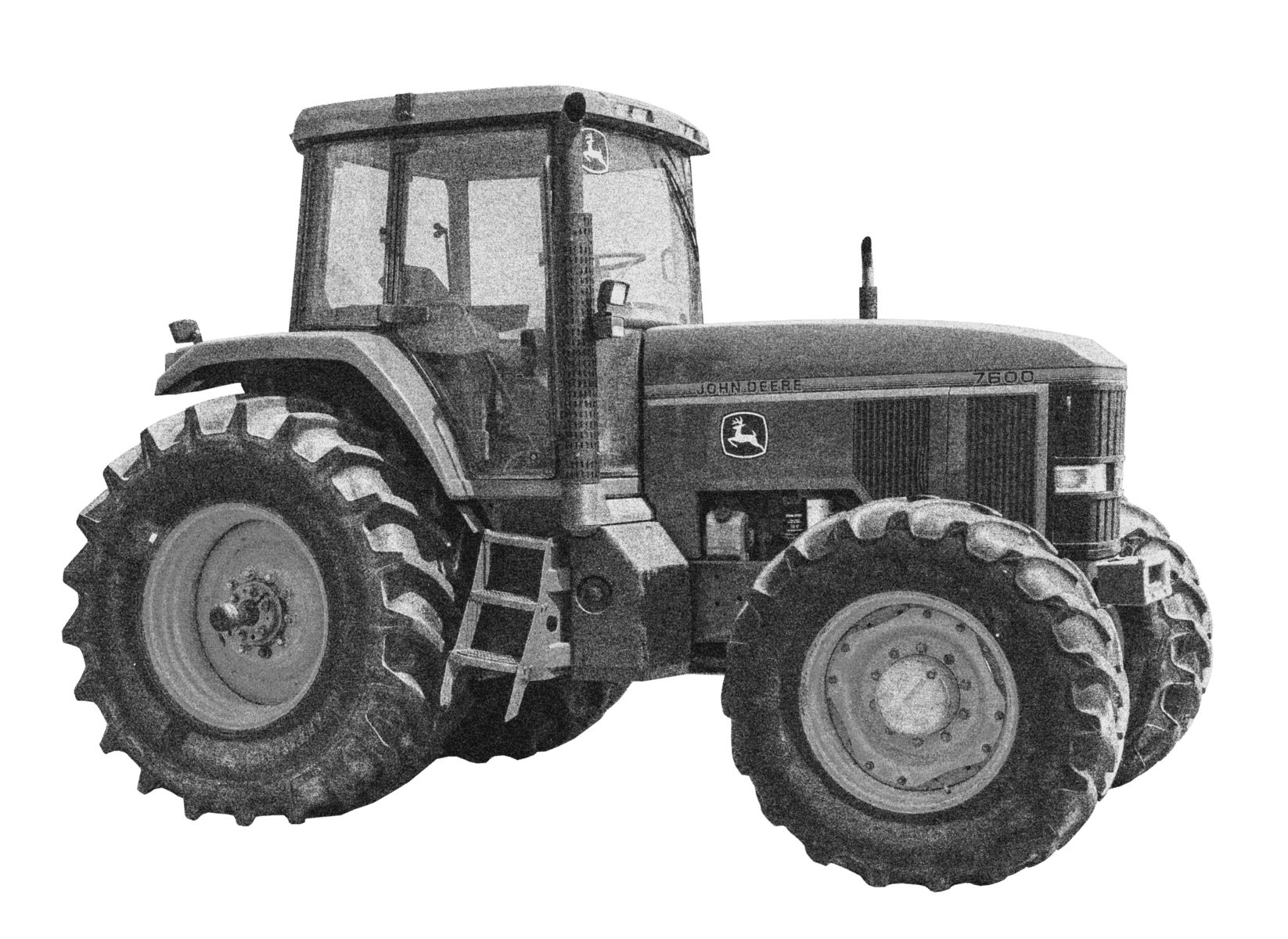

Workforce Development Programs

Ballad's Consulting Services

Economic Development

Driving growth with tailored strategies, workforce insights, and innovative solutions for municipalities and regions.

Business Services

Creating impactful strategies, housing solutions, and community-focused plans to drive growth and well-being.

Community Development

Empowering businesses with tailored plans, feasibility insights, and strategic solutions for growth and success.