Alberta’s labour market is continuing its recovery, with the unemployment rate (6.5% in March 2022) falling below pre-pandemic levels and employment demand accelerating across several sectors.[1] The labour market has added a further 22,000 jobs so far in 2022, broadly shrugging off the effects of the Omicron variant and bringing total employment in the province to a new all-time high, while the numbers of people working from home are on a steady decline as business conditions normalize. The progress made at the aggregate level is remarkable, with the recovery’s pace and breadth surpassing most expectations and many of the pandemic’s distributional effects have by now been overcome.[2]

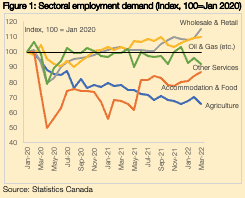

Beneath the surface, however, there are several points of divergence across the labour market’s subgroups. Most notably, while employment has rebounded in sectors such as natural resources (e.g., oil and gas) or retail and wholesale trades, performance in others has been much weaker so far (Figure 1). These weaker sectors include accommodation and food services (-13% relative to pre-pandemic levels) and other services (-8%), both of which were exposed to public health restrictions that limited face-to-face interactions and severely weighed on demand, while the sharp decline in employment in the agriculture sector (-34%) reflects labour supply issues and travel restrictions on seasonal workers.

The pandemic’s effects on labour supply more generally remain evident: the participation rate (69.3%) is 1-3 percentage points (pps.) lower than pre-pandemic levels, with the decline especially sharp (-6 pps.) among males aged over 55 years. There are specific issues restricting the participation of this labour market cohort: their health risks of contracting the virus are materially larger than younger workers;[3] while appreciating asset prices (real estate, financial) over the past two years has likely added to their wealth, in turn bringing forward retirement dates. This combination may have prematurely removed some workers from the labour market and risks turning the pandemic’s temporary negative shock into a much more persistent one, particularly as retirement decisions are often difficult to reverse.

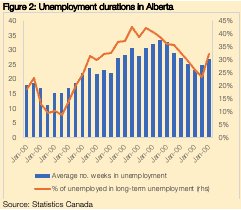

Such permanent changes in the labour market that result from temporary shocks are referred to as ‘hysteresis’.[4] In Alberta’s case, we are concerned that permanent changes following the pandemic may include: (i) lower participation rates among certain cohorts (as just illustrated); and (ii) the greater numbers in long-term unemployment and difficulties in reskilling and retraining this segment of the labour market. Concerning the former, the onset of early retirements raises questions as to whether new workers will be able provide an offset, both in terms of overall numbers and productivity levels. As for long-term unemployment, meanwhile, labour market data is already pointing to this challenge: the average number of weeks in unemployment currently sits at 26.8 (compared to 17.9 weeks

pre-pandemic), while around one-third of all unemployed are long-term (Figure 2). With unemployment spells remaining elevated even in the context of a growing economy and strong labour market, there are worries that this cohort is getting left behind. As argued by the Business Council of Alberta (2021), extended periods of unemployment lead to declines in lifelong earnings, especially for older workers that are missing out on some of their highest years of earnings.

Poloz and Wilkinson (1992) provide succinct summary of the forces behind hysteresis, which include: (i) deteriorating human capital as skills deteriorate with lengthening spells of unemployment or non-participation; (ii) insider-outsider models in which those who remain in employment prefer to keep real wages high rather than make room for the unemployed to return to work; and (iii) institutional models which show that regulations, entrenched behaviours, and rigidities reduce the labour market’s capacity to adjust to shocks.

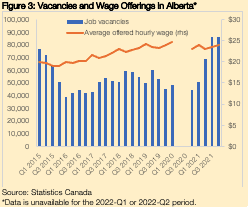

Concerns over hysteresis in the labour market are amplified by widespread vacancies that are going unfilled. The total number of job vacancies was at record highs of 86,000 across the province during 2021-Q4, corresponding with a vacancy rate of 4.3% (Figure 3). The region of Banff-Jasper-Rocky Mountain House and Athabasca-Grande Prairie-Peace River appears to have an especially high vacancy rate of 5.7%, reflecting differences in the composition of its local economy and higher exposure to in-demand sectors. Data at the national level shows that accommodation and food services (9.8%), construction (6.0%), healthcare and social assistance, and other services (5.8%) have the highest vacancy rates, and these challenges are likely to be even more acute in rural areas where the pool of available labour is smaller.

This data is corroborated by employer surveys, many of which concur on staffing shortages and barriers to finding appropriate employees. For example, Alberta Chambers of Commerce and the Business Council of Alberta (July 2021) found that a lack of applicants, lack of skills, and competition from other employers were the main barriers to hiring, with this already starting to affect output and limiting capacity to grow. The data also seem to suggest bifurcation into: (i) lower skilled positions for which it is relatively easy to find workers; and (ii) higher skilled positions requiring a university education or trade certificates, with the pool of suitable applicants for these roles much more limited. This bifurcation adds to our concerns over the labour market’s near-term capacity to replace retiring workers with greater experience, skillsets, and productivity. Similarly, recent reports from the Canadian Federation of Independent Business (CFIB) show that almost half (46%) of Albertan small businesses are experiencing staff shortages, with one-quarter (24%) estimating that current shortages are affecting business operations; while Business Development Bank of Canada (BDC) found that many small- and medium-sized businesses must leave their vacancies open for several months.

These surveys point to another source of reduced labour supply: many workers in industries most affected by the pandemic (e.g., personal services, hospitality) have left in search of more stable employment elsewhere and incentives to return are limited. BDC research finds that 20% of those who became unemployed during the pandemic switched sectors, while CFIB found that this percentage is even higher among people who were laid off from the hospitality sector (48%). Concerningly for employers in the industry, research from Statistics Canada (2018) found that job quality was lowest among all industries and often characterized by low pay and benefits, long and unpredictable hours, and physically demanding tasks. This suggests that any rebound in employment in the sector may have to be prompted by a resolution of these deep-rooted issues. Employers have started to raise wages for new vacancies. The average offered hourly wage rose to $24.05 in 2021-Q4 and is now in broadly line with pre-pandemic levels (Figure 3), while wage growth more generally has also been picking up in recent months in some sectors. Other incentives offered by employers include higher benefits packages, flexible hours, and hybrid or fully remote working arrangements.

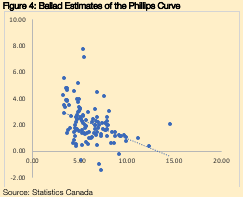

While we have not yet estimated Alberta’s structural unemployment rate, current labour market and inflation dynamics suggest that this level has already been breached. Indeed, rising vacancies, accelerating wage growth, and the highest rates of inflation in decades point to a provincial economy that is entering excess demand. Our initial estimates of the Phillips Curve (Figure 4) – which shows the inverse relationship between unemployment and inflation – show that a 1 pp. decline in the unemployment rate increases inflation in the province by 0.3 pps. Our views are thus corroborated by inflation continuing its path higher, coming in at 6.5% y-o-y in March.

That these high inflation rates are appearing at a time when overall and long-term unemployment are still high points to structural issues that are at play, some of which are likely to have been in place prior to the pandemic. These issues include a mismatch between the skills demanded by employers and those currently offered by the labour market. The province has come through successive shocks in recent years, starting first with the energy sector-led recession in 2015-16, followed later by the pandemic and its corresponding reallocation of labour across sectors. This has likely further aggravated pre-existing skills mismatches, as well as raised the structural unemployment rate in Alberta. In theory, further labour market gains from here will place upward pressure on wage growth and inflation rates.

So, what are the near-term policy levers for addressing these shortages? Alberta has previously been able to rely on seasonal and temporary workers to fill some of these gaps, especially in the hospitality sector. However, international travel restrictions have constrained this source of workers, while the provincial government’s initial pandemic response plan explicitly reduced the numbers of international workers that it would accept in an effort to reserve any openings for Albertans. Given the current labour shortage, the provincial government has done a remarkable about-face and has committed to spending $15m over the coming three years to ‘create national and international awareness of the benefits of living, working and investing in Alberta’. While potentially a short-term solution, such measures are tangential to the deeper structural issues facing the labour market, particularly as international immigrants mostly congregate in Toronto and Montreal (Cross, 2015). Addressing the labour market’s structural issues will require more innovative reforms, particularly in terms of providing new entrants and disadvantaged groups with the necessary skills to replace those lost through demographics and retirements. Evidence from Ballad’s interactions with clients and businesses in rural communities’ further underlines employers’ worries regarding new entrants’ skillsets, potentially hampered by how incentives were structured (e.g., CERB/EI) and a reassessment of whether previously popular sectors (e.g., hospitality) remain attractive.

Fundamentally, we believe that the provinces current labour shortages are a result of three key trends: (i) pandemic-related health risks and significant increases in net worth are estimated to have prematurely brought forward retirement dates for older cohorts, in particular males over the age of 55; (ii) temporary layoffs that occurred during the early stages of the pandemic are proving difficult to reverse as workers have switched to more stable sectors; and (iii) there are still over 50,000 Albertans who have been out of work for over 6 months, with their skills and employability deteriorating over time. Our views appear to be borne out by the data – especially the signs of accelerating wage growth and inflation as labour shortages become binding – and engagement with employers that are foregoing sales, suggesting that these structural issues and shortages are already starting to weigh on growth.

An effective approach to addressing labour shortages must recognize each of these trends and develop appropriate responses. The recently announced $600m Alberta at Work program goes in a positive direction, adding training places for in-demand occupations. Over the longer term, however, bringing Alberta’s structural unemployment rate to lower levels will require initiatives that continuously augment the skillset of the entire labour market, how it corresponds with employer demands, and the steps that can be taken to bridge gaps now and into the future. Until then, Alberta’s labour market will remain exposed to boom-and-bust energy price cycles and the volatile labour market conditions that they produce.

[1] The unemployment rate peaked at 15.3% in May 2020 as the provincial economy entered lockdown. The labour market has added almost 400,000 jobs since the low point of the pandemic.

[2] For example, both male (6.4% in March) and female (6.7%) unemployment rates have converged to similar levels, whereas females were initially much more adversely impacted by school and daycare closures and the resulting shift of childcare responsibilities.

[3] Employers’ expectations that workers return to the office are also accelerating. For those workers most at risk, more limited options for working from home are likely to further reduce incentives to participate in the labour market.

[4] More technically, as defined by Poloz (1992), ‘A variable is said to exhibit hysteresis if there is no tendency for it to revert to some mean value after a disturbance causes it to change.’