On February 24th, Travis Toews set out his Ministry’s views on the provincial government’s fiscal position, presenting an upbeat assessment that few would have thought credible just a short time ago. In particular, a combination of higher royalties from natural resources, rising tax receipts as the economy reopens, and declining pandemic-related spending will see the province deliver a modest budget surplus ($511m) in the next fiscal year, its first in almost a decade. This fortuitous turn of events – particularly the return of oil prices above $100 per barrel in recent weeks – ensures that the fiscal anchors set by the provincial government have by now been achieved.[1]

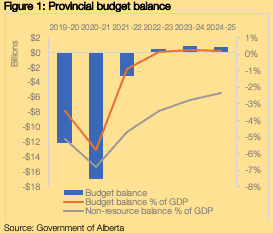

After swelling to $17bn in fiscal year 2020-21, the budget deficit will fall to just $3.2bn in 2021-22 and will be eliminated entirely thereafter. The province is forecasting modest surpluses of between $500 and $900m (or 0.1%–0.2% of GDP), with these currently allocated to restoring the Heritage Savings Trust Fund or paying down debts. In turn, budget surpluses will limit the accumulation of taxpayer-supported debt which is now forecast to stabilize at just under $100bn, while net debt-to-GDP is projected to fall gradually towards 15% over the coming three-year period.

A significant portion of the turnaround in provincial finances is attributable to natural resource revenues coming in much higher than previously expected. This increase has been driven by rising global demand as the pandemic subsides; low inventories and supply constraints after years of declining investment in the energy sector; and the current conflict in Ukraine and corresponding sanctions on Russia, one of the top crude oil producers globally. This tailwind has opened some fiscal space for spending on critical priorities in the near term, while the province’s prudent estimates for oil prices going forward provides an opportunity for revenues to surprise on the upside in future years.

This brings us to a crucial question that the budget poses: what new anchors should be put in place to ensure that Alberta’s finances remain sustainable going forward? After all, much of the revenue gains have been driven by higher oil and gas prices, pointing to a budgetary process that is still highly volatile and exposed to shifting commodities prices. An appropriate fiscal framework going forward must be one that limits pro-cyclical behaviour when oil prices are high, as well as building up reserves to offset future downturns. This will require a fundamental rethink of how resource revenues are managed going forward, as well as continued discussion on whether higher taxes are needed elsewhere.

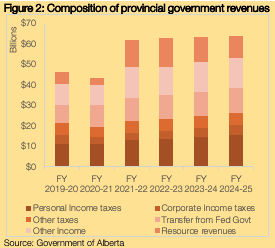

At the aggregate level at least, it appears that some progress will be made in insulating the budget from oil price fluctuations. The budget balance when resource revenues are excluded is forecast to fall from over $20bn in 2020-21 to just over $10bn by 2024-25 (Figure 1). Much of this improvement is driven by robust growth in personal and corporate income taxes, contributing around half of all growth in non-resource revenues over the period (Figure 2).[2] Overall, provincial government revenues are forecast to rise to just under $64bn in the coming years, with modest declines in resource revenues from their current highs offset by gains elsewhere.

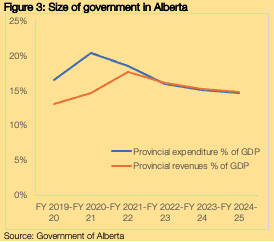

It should be noted that overall provincial tax burden in Alberta remains small, especially when compared with other provinces or competing locations for investment.[3] This feature of our economy is often pointed to as a cornerstone of the ‘Alberta Advantage’. However, spending pressures will continue to rise in the coming years (e.g., healthcare) and the province’s central role in providing critical infrastructure will need to be fulfilled.

On the spending side, the improved fiscal and economic outlook has provided the government with room to increase spending in critical areas such as health, education, and labour market development. Excluding pandemic-related spending and one-offs, operating expenditure is forecast to rise from $49bn in the current fiscal year to almost $52bn by 2024-25 – an average annual increase of around 2% – while total government spending is set to rise from $61bn to $63bn over the same period. However, these numbers sound less impressive when considered against a backdrop of inflation running at 5% across Canada. In real terms, both revenues and spending will fall over the coming years (Figure 3). As such, for those worried about government largesse, this budget is by no means a giveaway; government ministries and agencies must continue looking for efficiencies in how they deliver their services.

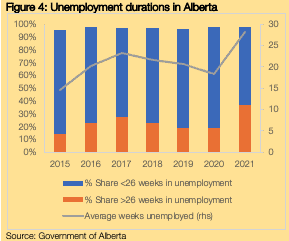

The need for maximizing spending efficiency is especially pronounced at the Ministry of Labour and Immigration which received an additional $600m over three years for implementing the Alberta at Work initiative. The provincial government’s renewed focus on the labour market is much needed given continued challenges and widespread evidence of skills mismatch. For example, while the unemployment rate – 7.2% in January 2022 – and the overall number of jobs have both recovered to their pre-pandemic levels, the participation rate remains lower and suggests that some cohorts have detached. This concern is amplified further by the increase in average length of time spent in unemployment, which now stands above 28 weeks (Figure 4). These people will face severe barriers in returning to employment in the absence of policy interventions such as reskilling and retraining.

Labour market displacement prompted by the pandemic and successive years of weakness in the energy sector are especially visible across rural Alberta. Much of the funding announced, from building basic literacy skills to enhancing apprenticeship programs or additional seats in technology-related fields, will be instrumental in lowering unemployment across rural communities. These programs coincide with the province’s broader commitment to broadband infrastructure, additional healthcare personnel, and attracting skills to rural areas. Rural municipalities should already be considering how best to take advantage of these programs.

In summary, the provincial government finds itself in an unquestionably more favourable position than just a year ago. It must be emphasized, however, that higher oil resource revenues are not providing Alberta with an indefinite get-out-of-jail-free card; with the exceptions of a few programs, most government ministries will have to closely monitor spending and find efficiencies. More generally, the reprieve offered by higher oil and gas prices should not distract from the difficult choices still facing the province in building a sustainable fiscal framework going forward. These choices include the optimal mix of tax and resource revenue for funding government expenditure, investing today to fund critical infrastructure and labour market interventions, and building up a reserve fund for future downturns, to name a few.

The Alberta Advantage remains strong in early 2022, as evidenced by the economy’s robust recovery and strong outlook in the coming years. These fiscal policy choices mentioned should be thought of as complementary to that advantage rather than detracting from it. Alberta’s economy and business community will be much better served by a stable, growth-friendly composition of tax and spending rather than the pro-cyclical boom-bust cycles to which it has become accustomed.

The Ballad Auger is written by Senior Research Analyst, Alan Gilligan.

[1] These fiscal anchors include: (i) restoring the provincial budget to balance; (iii) keeping the province’s debt levels low; and (iii) bringing per capita spending into line with other provinces.

[2] Significant contributions are also made by increases in revenues from ‘Investment income’ and ‘Net income from government business enterprises’.

[3] For example, total provincial revenues-to-GDP will amount to 17.6% in the current fiscal year (2021-22) and are expected to fall to just 14.8% of GDP by 2024-25.