In our previous issue, we outlined some of the risks facing the outlook for inflation and the benign assessment that price pressures were ‘transitory’. In early 2022, with headline consumer prices rising at almost 5% annually and core inflation firmly above the Bank of Canada’s target range, the narrative surrounding monetary policy has shifted markedly, with most commentators now questioning how quickly a tightening cycle might proceed in the near-term. These dynamics have important implications for the nascent economic recovery underway in Alberta, as well as how the pandemic’s many economic legacies are to be addressed going forward.

In our estimation, the principal risk at this stage is that high inflation becomes entrenched, prompting interest rates to rise sharply in order to re-anchor expectations. For 2021 as a whole, consumer prices rose by 4.8% year-on-year, driven by rising costs for energy, durable goods, and food; while price pressures have retained solid momentum as core inflation rose a further 0.4% month-on-month in December.[1] In addition to this momentum, many of the underlying factors pushing up prices that we highlighted previously (wage growth in some sectors, supply chain shortages, late stage of the economic cycle) remain in place, and inflation expectations have been rising in recent months.

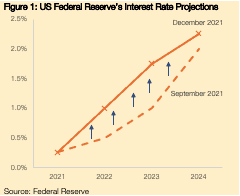

Central banks have already signalled their intention to raise interest rates in the near-term. Most notably for Canada given its close economic ties to the United States, the Federal Reserve’s most recent projections include a marked upward revision to its forecast for interest rates (Figure 1). While rates remained at historic lows at 0.25% in December 2021, the Federal Reserve is expecting 3 rate increases in 2022, bringing interest rates to 1% by year-end, followed by a further 3 rate hikes in 2023.[2] This projected pace of tightening is sharper than projections just three months previously, and points to growing concerns over falling behind the curve in taming inflation. At the same time, policy hawks are concerned about spillovers from loose monetary policy to asset prices and the buildup of imbalances in the financial sector. Concurrent with raising interest rates, the Federal Reserve will also likely consider unwinding its almost $9 trillion (US) balance sheet over the coming period.

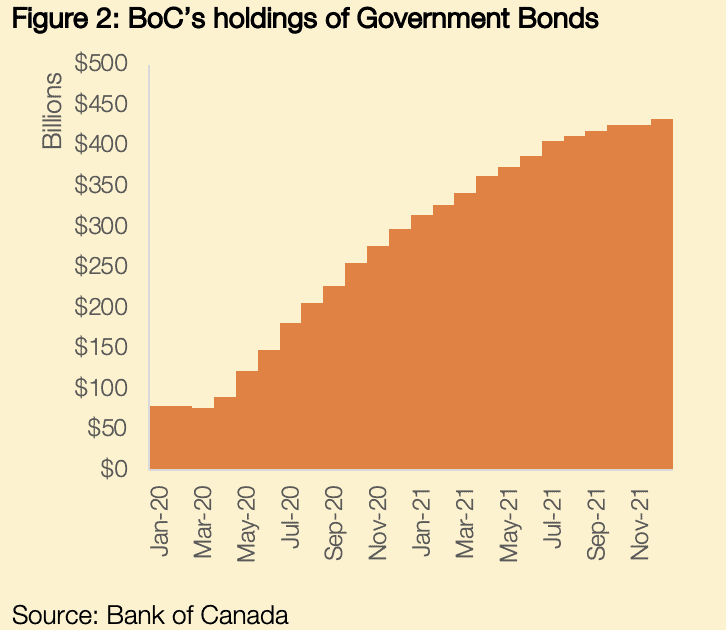

The Canadian and US economies are highly integrated, meaning that monetary policy stances often follow the same pattern.[3] Last week saw the Bank of Canada (BoC) release its latest monetary policy decision and accompanying Monetary Policy Report. While holding off on a rate rise for the moment, the BoC has already moved to start reining in some of its stimulus: purchases of additional federal government bonds under the Government of Canada Bond Purchase Program (GBPP) have ended, with the BoC shifting to a ‘reinvestment phase’. This has left the BoC holding some $430bn in federal government bonds (Figure 2), or almost half of all federal government bonds outstanding. Going forward, a benign economic environment would likely prompt the BoC to allow these bonds to mature gradually.[4]

The value of federal government bonds held by the BoC has increased by 550% in the two years since the pandemic began and is estimated to have lowered yields on federal government bonds by an average of 10 basis points (Bank of Canada, 2021).[5]

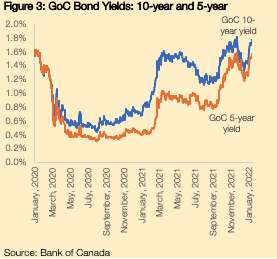

In response to the anticipated tightening of BoC policy – including via interest rate increases and the eventual unwinding of federal government bond holdings – asset prices have already started to adjust. Most notably, yields on long-term debt have risen to pre-pandemic levels and are likely to receive further upward impetus as the economy moves towards excess demand and supply constraints are already binding. Added to this, while many pandemic-related supports are being removed, the federal government will continue to run modest deficits over the coming years, coming in at -2.2% of GDP in FY 2022-23. This combination will put upward pressure on yields for federal government bonds, in tandem raising borrowing costs across other Canada-based debt instruments in financial markets. For example, yields on 10-year Canadian government bonds have more than tripled from 0.5% in mid-2020 – the most acute phase of the pandemic – to above 1.7% in recent weeks (Figure 3).

In order not to sound overly alarmist, it is necessary to keep some of these numbers in perspective. Firstly, during ‘normal’ economic conditions, falling yields on government bonds are often interpreted as a sign of impending recession and limited opportunities for capital to flow into productive investments. The nadir reached in mid-2020 is a perfect illustration of how yields fall in response to uncertainties or pessimism over the economic outlook. As a corollary, therefore, rising yields can be interpreted as signs of rebounding economic activity. Secondly, while yields (i.e. borrowing costs) have risen, it is important to note that they remain very close to historical lows; we are likely to still be some way off the level at which government or corporate debts become unsustainable.

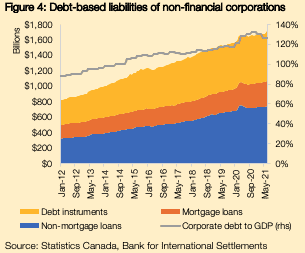

Now, back to the pessimism. The reason why rising inflation and tightening monetary policy have become such a concern is due to elevated debt levels across Canada. It is not just household debt and the Canadian housing market that should capture our attention; Canadian businesses have been borrowing at an exceptional pace (Figure 4). In the past 10 years – a period characterized by loose monetary policy and a brief tightening cycle – total debt-based credit liabilities of non-financial corporations more than doubled to reach almost $1.8tn.[6],[7]

Since the onset of the pandemic, meanwhile, Canadian businesses have added a further $175bn – an increase of 11% – to their debt levels, pushing non-financial corporate debt-to-GDP above 130%.[8] Furthermore, debt service ratios – which reflect the share of income used to service debt – have decoupled from other advanced economies and remained close 60% for a prolonged period. The onset of even a modest tightening cycle will at the very least curtail investment and economic growth, while potentially also creating solvency pressures on highly indebted Canadian businesses.

Since the onset of the pandemic, meanwhile, Canadian businesses have added a further $175bn – an increase of 11% – to their debt levels, pushing non-financial corporate debt-to-GDP above 130%.[8] Furthermore, debt service ratios – which reflect the share of income used to service debt – have decoupled from other advanced economies and remained close 60% for a prolonged period. The onset of even a modest tightening cycle will at the very least curtail investment and economic growth, while potentially also creating solvency pressures on highly indebted Canadian businesses.

Higher corporate debt levels have also resulted from the federal government’s response to the pandemic, the fiscal cost of which is estimated at over $500bn (Economic and Fiscal Update 2021). Of this amount, almost $100bn was allocated to the Canada Emergency Business Account (CEBA) and Business Credit Availability Program and Other Credit Liquidity Support, both of which provided vital liquidity to businesses during a period of falling sales. Without this support, the immediate economic effects of the pandemic would have been even more devastating. Nonetheless, as we look beyond the horizon of the current Omicron wave, we must ask a number of questions about the longer-term effects of these supports. These questions include the likelihood of businesses being able to fully repay these debts, as well as how appropriate it is that the federal government has become a major creditor to many Canadian businesses: according to Ballad’s estimates, $1 in every $12 of non-mortgage corporate loans is owed to government in some form or another.[9]

The risks highlighted by the data are borne out by Ballad’s engagement with the business community also. In work previously carried out across Alberta’s Athabasca-Grande Prairie-Peace River region, Ballad found that many business owners have relied on personal savings, taking on additional debt, and accessing public funding supports in order to survive the pandemic. In many cases, public funding – in the form of grants, loans, and subsidies – has proven the difference between survival and not. However, almost half of businesses surveyed had not yet given consideration to repayment plans for supports accessed from government (e.g., CEBA loans), pointing to solvency issues and the risk that high debt will weigh on growth for some time. As businesses have spent through their equity capital and taken on leverage, concerns are growing regarding future financial viability as they transition into the post-pandemic environment. In response to these concerns, the federal government has extended the repayment deadline by another year, providing temporary relief for a challenge that is likely to be persistent.

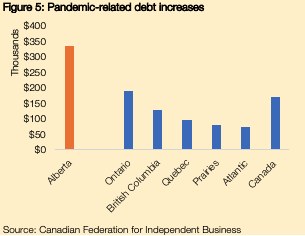

Our findings are corroborated by research from the Canadian Federation of Independent Business (CFIB) which finds that over 70% of Canadian small businesses have taken on debt to cope with the impacts of the pandemic (Small business debt and profitability: The COVID-19 Impact), with sectors such as hospitality and recreation especially affected. Of these businesses, 1-in-4 are concerned that they may never be able to repay. Most strikingly, the CFIB’s research also finds that average debts related to the pandemic are $335,000 in Alberta, double the national average. It seems, then, that our province faces greater challenges than others in transitioning into the post-pandemic environment given that many small- and medium-sized businesses are carrying elevated debt burdens with uncertain prospects of repayment.

It is easy to start thinking that the worst of the pandemic’s economic effects are behind us. After all, with economic growth of around 6% in 2021, the unemployment rate falling towards 7%, oil prices in the $80 per barrel range, and provincial government finances improving, the outlook in early 2022 is much more positive than just a short time ago. However, the pandemic’s legacies are likely to be more persistent than we would prefer; imbalances and distortions that have been built up will have to be addressed, and high debt corporate debts are the among the most concerning of these. A sharp monetary policy tightening cycle may mean that these imbalances are reconciled in a disruptive way. With less options to finance working capital, highly leveraged firms may need to cut costs or downsize to be able to shoulder interest payments in order to avoid bankruptcy. Beyond immediate bankruptcy risks, meanwhile, there is a more general concern over high debt levels and the weight that this may place on economic activity for many years to come.

It is easy to start thinking that the worst of the pandemic’s economic effects are behind us. After all, with economic growth of around 6% in 2021, the unemployment rate falling towards 7%, oil prices in the $80 per barrel range, and provincial government finances improving, the outlook in early 2022 is much more positive than just a short time ago. However, the pandemic’s legacies are likely to be more persistent than we would prefer; imbalances and distortions that have been built up will have to be addressed, and high debt corporate debts are the among the most concerning of these. A sharp monetary policy tightening cycle may mean that these imbalances are reconciled in a disruptive way. With less options to finance working capital, highly leveraged firms may need to cut costs or downsize to be able to shoulder interest payments in order to avoid bankruptcy. Beyond immediate bankruptcy risks, meanwhile, there is a more general concern over high debt levels and the weight that this may place on economic activity for many years to come.

At the provincial level, policymakers and funding organizations exposed to corporate debts should already be considering how to walk this tightrope going forward. There are a number of channels available for policymakers at all levels of government. These include providing additional resources and restoring equity of distressed firms; encouraging timely debt restructuring to allow distressed firms to continue operating smoothly; linking loan repayment (e.g., CEBA) to business performance; and improving the efficiency of liquidation procedures. Ultimately, however, the risk of supporting non-viable firms needs to be balanced against the risk of forcing viable and productive firms into premature liquidation.

Alberta retains some of the most enviable competitive advantages on the continent. In order to ensure that they are utilized to best effect, it is time to have some serious conversations around the most appropriate ways to fund our business community. Ballad has already started looking further into this challenge on behalf of policymakers across the province and is in the process of drawing up some innovative solutions that recognize that additional public funding via loans or grants is not going to sustainably shift our province towards a higher growth trajectory; only an efficient allocation of capital to productive businesses is likely to do so.

The Ballad Auger is written by Senior Research Analyst, Alan Gilligan.

[1] Price pressures have been somewhat more muted in Alberta, with core inflation at 1.3% in 2021. Nonetheless, the Bank of Canada (BoC) sets monetary policy for Canada as a whole, meaning that, while Alberta’s recovery has more room to run than other provinces, a tightening cycle will likely proceed given cross-Canada inflation at present.

[2] Financial markets have actually priced in an even faster pace of rate hikes going forward, with the expectation of at least 4 coming in 2022 alone.

[3] For example, Voss (2010) estimates that the US and Canadian business cycles have a strong contemporaneous correlation of 0.74 (with 1 being a perfect correlation).

[4] In order to prevent any market disruptions, this wind down is likely to take place gradually. For example, the BoC could simply no longer reinvest in federal government bonds once existing holdings reach maturity at various stages over the coming years. The BoC’s October Monetary Policy Report estimates that that 70% of its current holdings of federal government bonds will mature in the coming 5 years.

[5] Furthermore, the GBPP is expected to have had a greater impact on bond yields at shorter maturities. However, it should be noted that these estimates are subject to significant uncertainty and the BoC notes that the GBPP’s actual impact is likely larger than the 10 basis points figure presented.

[6] Total credit liabilities of non-financial corporations in Canada actually stands at $3tn, with this including $1.2tn in equities securities.

[7] While this aggregate gross figure is significant, it is important to note than some portion of this increased debt owing by non-financial corporations is mitigated by cash balances and deposits held with financial institutions, as well as the impact of intra-company lending. As such, in net terms the increase in debt levels may be less dramatic.

[8] This has been led by increases in mortgage loans (+16%), non-mortgage loans (+10%) and long-term debt instruments (+7%)

[9] This figure is calculated from Statistics Canada’s Table: 36-10-0640-01. A total of $773bn in non-mortgage loans was owed by Canadian non-financial corporations in November 2021, of which $61bn was owed to government. The corresponding pre-pandemic figure owed to government was $18bn in January 2020.