Strong uptake of vaccines across the province has prompted the swift removal of most public health restrictions. While uncertainties and risks regarding new variants remain, this recent progress is generating optimism that we may be approaching a definitive endpoint to the COVID-19 pandemic and its severe consequences. In economic terms, these consequences have included a sharp slowdown in economic activity, widespread disruption in the labour market, and elevated public sector deficits, among others. Although recovery across each of these areas still has significant room to run, it is a welcome development that narratives have shifted towards addressing the pandemic’s legacies and orienting Alberta’s economy towards future areas of growth.

The appearance of more routine economic conditions on the horizon is accompanied by debates on how economic policy can successfully manage the transition into a post-pandemic environment. There are questions on how to prudently unwind the demand-side supports given to businesses and households without stifling the recovery underway, balanced on the other hand with concerns over the distortions, imbalances, and inefficiencies they have created. Some of these adjustments are already taking place: at the provincial level, fiscal policy is shifting its focus towards deficit reduction and reigning in public spending, while other arms of government are tackling competitiveness and productivity issues on the supply-side.

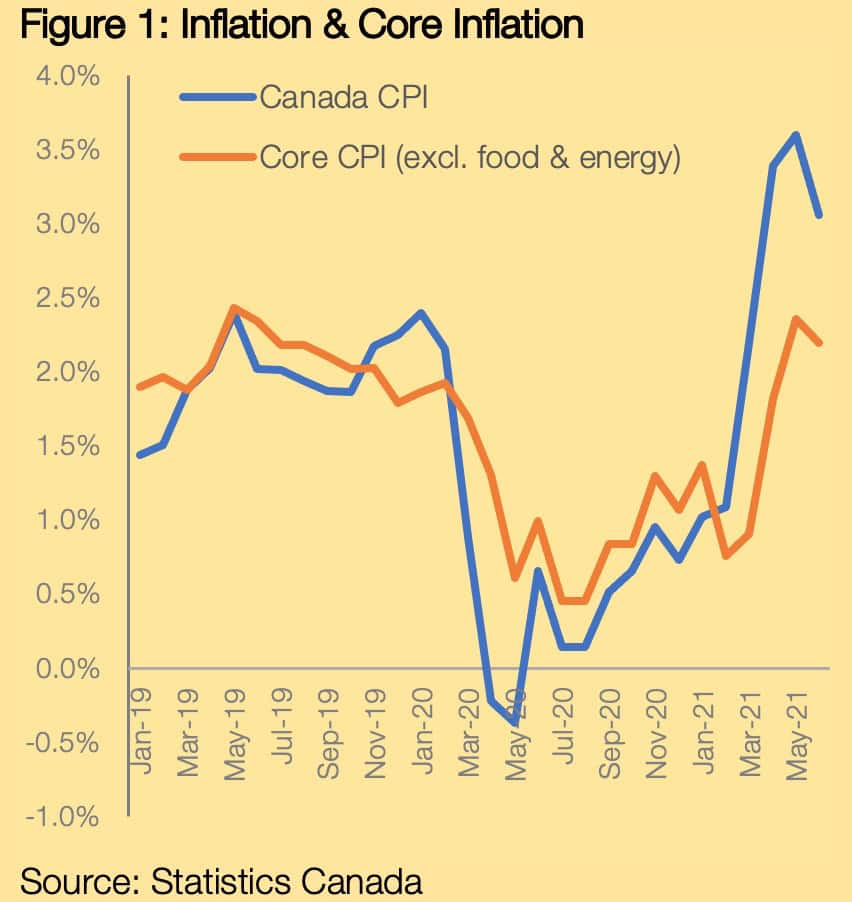

Monetary policy had been receiving less attention by comparison – until recently, that is. The release of June’s Consumer Price Inflation (CPI) figures points to the emergence of price pressures in some key areas. Headline CPI came in at 3.1% year-on-year (y-o-y), completing a hattrick of recent inflation releases above 3% (Figure 1). This is marginally above the Bank of Canada’s inflation target and has put a renewed spotlight on when interest rates might begin to rise.

It is important to note that much of the recent increase in the CPI relates to: (i) statistical base effects from 2020 in which economic activity and prices were exceptionally low due to global lockdowns; and (ii) surging energy prices which were 19.5% y-o-y higher in June. When looking at core inflation – which excludes volatile items such as food and energy prices – price pressures were much more muted at 2.2% y-o-y.[1] That is not to say that recent inflation dynamics are unimportant; just that they are unlikely to trigger significant concern among policymakers in the near term. Nonetheless, there are a number of interesting features from the inflation data to note.

Firstly, the emergence of price pressures at this very early stage in the recovery is surprising: core inflation, at 2.2% y-o-y, has risen markedly (up from less than 1% earlier in the year) even though unemployment remains high and there is widespread evidence of slack in the economy. For example, Bank of Canada (BoC) estimates that the output gap is currently at between -3% and -2%, while its composite measure of labour market performance remains weaker than the pre-pandemic period; the economy remains some distance from the point at which we would expect inflation to appear.[2],[3]

Secondly, wage pressures play a key role in driving inflation and inflation expectations. Counterintuitively, average wages across Canada actually rose sharply during the early stages of the pandemic as a disproportionate number of lower-income workers were laid off. These dynamics continue to distort the data as many of these workers have by now returned, but employer surveys point to rising employment and higher wage demands in the near term.

Employee demands for higher wages seem anomalous given still-high unemployment and the broader uncertainties surrounding the labour market’s recovery. There are several reasons for this: (i) experienced staff in some sectors (especially retail and accommodation and food services) have sought work in other, more resilient sectors, reducing labour supply;[4] (ii) more generous income supports (e.g., Employment Insurance, Canada Recovery Benefit) may have contributed to rising reservation wages in some sectors, particularly lower-paying ones;[5] (iii) there have been changes in workers’ needs, with staff demanding more flexibility in terms of hours and remote working; and (iv) structural changes such as automation or technologies have placed an even greater premium on skills.

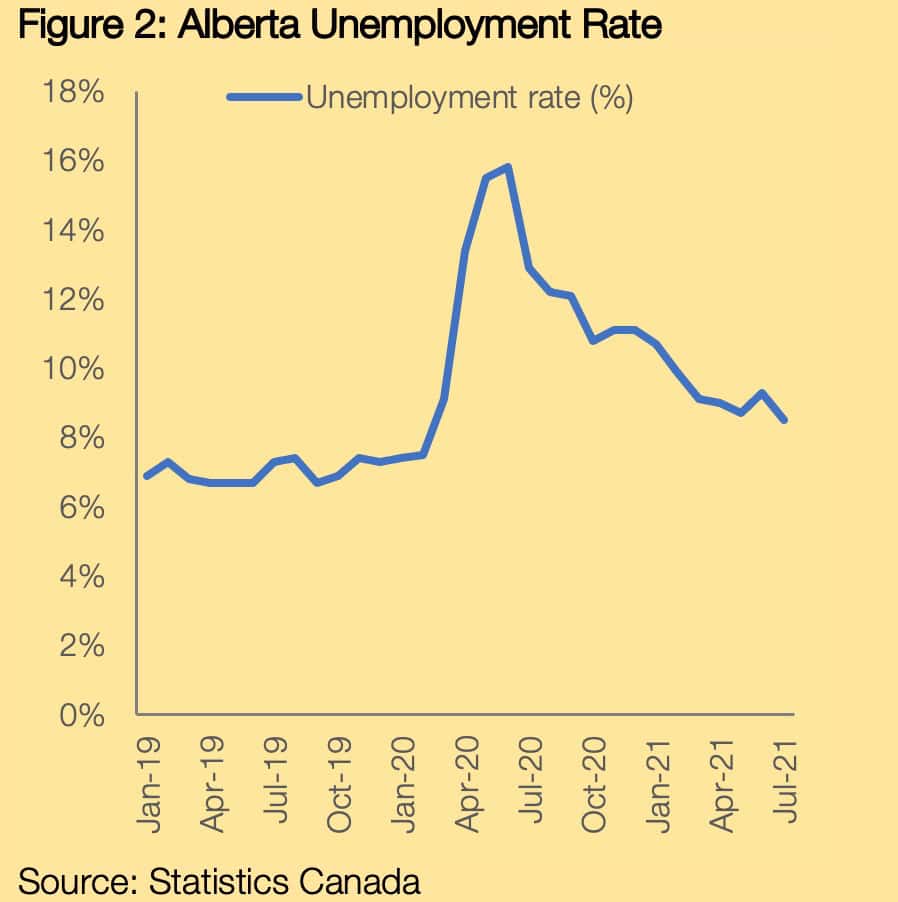

In the context of Alberta’s unemployment rate of 8.5% and employment remaining 1% below pre-pandemic levels, this points to potential signs of mismatch in the labour market and a period of adjustment to come (Figure 2). In June, for example, job postings rose by over 30,000 – well above historical averages – even as full-time positions decreased by 37,000. Our initial estimation at Ballad is that some workers displaced by the pandemic may not have the requisite skillset to immediately transition into growing sectors, making a higher structural unemployment rate a likely feature of recovery. This requires some thought among policymakers and business owners regarding skills needs and how labour supply can best meet these. In the meantime, higher wage pressures may be something that employers have to tolerate, in turn passing some of these costs on to consumers.

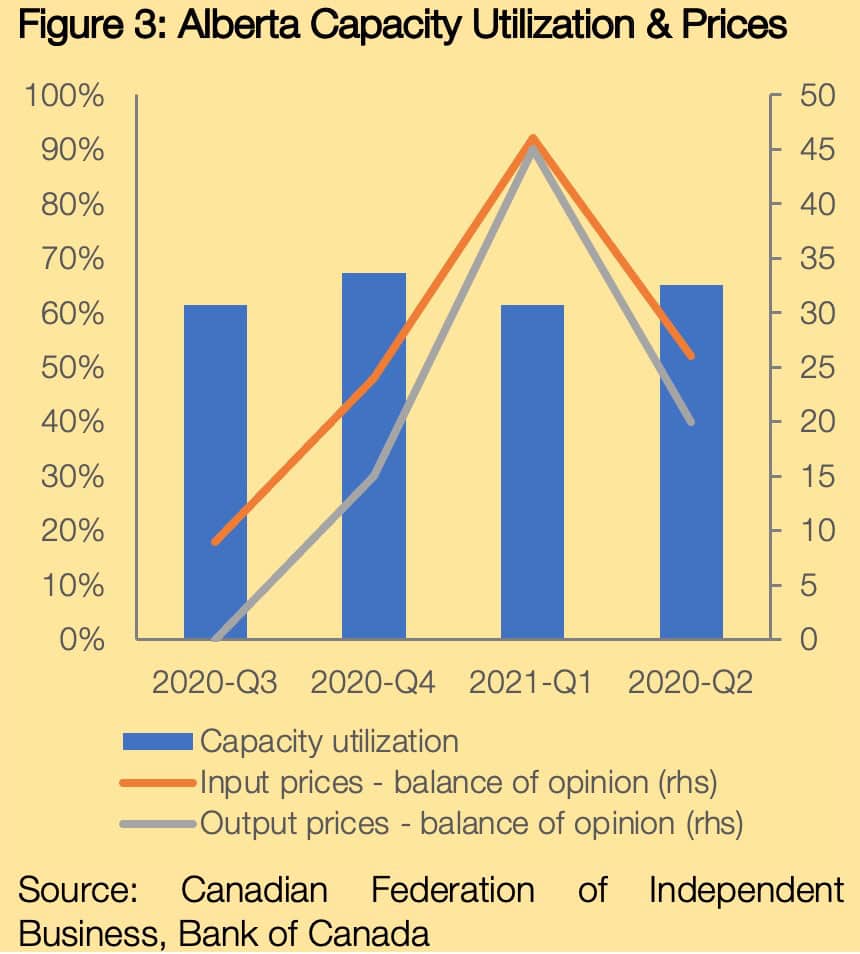

Finally, upward price pressures also stem from supply chain disruption and production bottlenecks. The price of durable goods increased by 3.9% y-o-y in July (up from 1.4% in 2020), while survey indicators point to continued rises in input and output prices across manufacturers. This data corroborates Ballad’s own engagement with Albertan businesses which identified severe supply chain issues, including difficulties in securing raw materials, intermediate, and final goods; lengthy delays in having orders refilled from suppliers; as well as higher shipping costs and difficulties in securing freight services. Most businesses that we’ve spoken with expect these supply chain issues to persist into at least 2022 as economic recovery progresses and businesses catch up on delayed investments and capital spending.[6]

Given the severity of supply chain challenges and their importance for both businesses’ and public sector capital spending plans, we will be taking a deeper dive into supply chain dynamics in the post-pandemic economy as part of our forthcoming issues. Entire industries are in the process of reorganizing their supply chains and it will be essential for Alberta’s business community and its advocates at all levels of government to take advantage of these shifts. Further to this, Ballad is looking forward to hosting a webinar which examines these issues with supply chain experts over the coming months, including analyzing potential measures that policymakers at all levels of government can take to address these.

Taking all of the factors outlined above, the stage appears to be set for sustained upward pressure on prices into 2022 at least: wage pressures are high despite a weak labour market; supply chain issues are restricting production; businesses will be raising their capital spending; and consumers are expected to continue drawing down savings accumulated during the pandemic.[7] The question regarding what happens in policy terms is really two-fold: (1) To what extent do these underlying dynamics push inflation materially above the BoC’s target range? And (2) to what extent will the BoC will tolerate an inflation overshoot?

If these underlying dynamics are estimated to be transitory, then it seems likely that BoC will allow for a temporary overshoot until the economy recovers fully (in whatever shape that may look like). However, there are risks with this approach: a sustained period of high inflation that raises inflation expectations among households and businesses could set in motion a circular and self-sustaining pattern of above-target inflation that may be difficult to rein in. So far, inflation expectations have remained stable around the 2% level and have not prompted immediate concerns. However, this may change rapidly if current pressures do not subside or are replaced by unforeseen new ones.

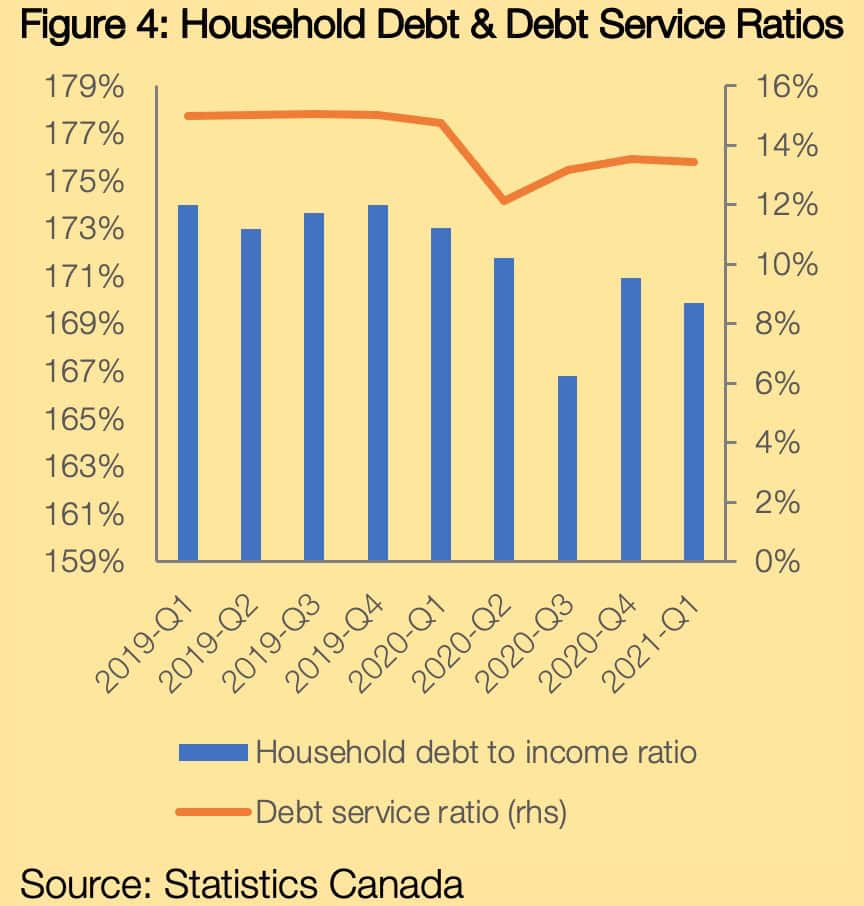

Beyond inflation dynamics, BoC’s accommodative monetary policy stance – with rates at 0.25% and its balance sheet growing to $400bn in government bond purchases – entails risks in other areas. This includes their effects on asset prices, especially in the housing market which has seen home prices soar during the pandemic. Meanwhile, household debt levels remain elevated and debt service ratios will likely rise from their current exceptionally low levels (Figure 4).

These policies eased financing conditions and provided vital liquidity during the most acute phase of the pandemic. Going forward, the challenge lies in finding an approach that balances supporting growth in the near term while recognizing the risks that these policies create over the long run. This backdrop of a large build-up of imbalances concurrently across the real economy, labour market, and asset prices has raised the stakes, and is perhaps why the prospect of higher inflation has alarmed some commentators.

A large inflation overshoot that requires interest rate hikes would severely weigh on growth and likely prompt disruptive price movements across a range of asset markets. Meanwhile, economists working at the federal, provincial, and municipal levels now have much less policy space available to offset such economic headwinds than they did prior to the pandemic. After a year-and-a-half of repeated lockdowns and economic disruption, there are few worse ways that Alberta’s businesses and labour market could enter the post-pandemic environment. If this turns out to be the case, it will take all of Alberta’s entrepreneurial spirit, exemplary work ethic, and innovative policymaking to draw a definitive line in the sand on the province’s weak economic performance over recent years.

The Ballad Auger is written by Research Analyst, Alan Gilligan.

[1] In Alberta, meanwhile, core CPI was even lower at 1.0% y-o-y in June 2021.

[2] In line with Bank of Canada’s definition, the output gap is the difference between the economy’s actual output and the level of production it can achieve with existing labour, capital, and technology without putting sustained upward pressure on inflation.

[3] Bank of Canada (2021), Monetary Policy Report July 2021.

[4] Ballad’s engagement with businesses across Alberta confirms the staffing difficulties facing businesses in these sectors.

[5] The reservation wage can be defined as the lowest wage an unemployed person would accept in order to become employed. As a consequence, higher unemployment benefits (or higher taxes on labour) may require higher wages in order to entice workers from unemployment.

[6] Among the most well-publicized of these supply chain issues has been the global shortage of semiconductors, resulting in knock-on effects across a wide range of industries, including autos. The long lead-time in production and ramping-up manufacturing activity ensures that such shortages can only be alleviated gradually.

[7] Canada’s household savings rate (at around 12% at present) remains more than twice the pre-pandemic level.