On the surface at least, much of the tone surrounding the Government of Alberta’s latest budget – released on February 28th – has focused on the additional funding promised to several parts of Alberta’s public service. Indeed, there are significant up-front increases in operating expenses for healthcare (4.1% in fiscal year 2023-24) and social services (8.8%), both of which are front-of-mind for voters as we approach the upcoming election: the challenges facing healthcare delivery include excessive emergency department and surgical wait times; while a year of high inflation and volatile energy prices have prompted the Affordability Action Plan, comprised of direct payments to households, energy rebates, and fuel tax reliefs.

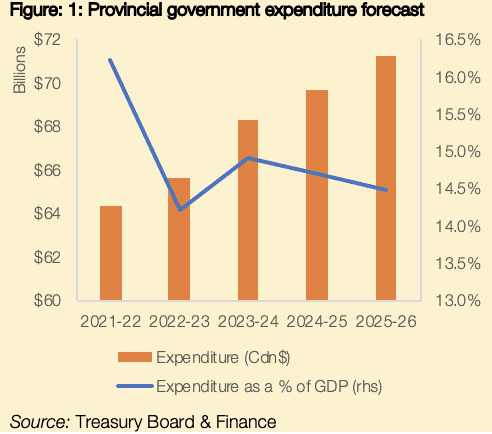

However, labelling this budget a “pre-election giveaway” is not quite accurate either, with much of the fiscal restraint shown throughout Treasury Board & Finance Minister Toews’ tenure remaining intact, both at the aggregate level and for individual programs. For example, even after accounting for increases in the areas highlighted above, total operating expenses are forecast to grow at an annual pace of 2.2% in nominal terms over the coming three years. Given successive years of high inflation and double-digit growth in nominal GDP, such expenditure growth does not appear excessive.[1],[2]Total provincial government spending – while increasing somewhat in the near term – will remain below 15% of GDP throughout the coming period (Figure 1), a level which remains markedly lower than other parts of Canada.[3]

However, labelling this budget a “pre-election giveaway” is not quite accurate either, with much of the fiscal restraint shown throughout Treasury Board & Finance Minister Toews’ tenure remaining intact, both at the aggregate level and for individual programs. For example, even after accounting for increases in the areas highlighted above, total operating expenses are forecast to grow at an annual pace of 2.2% in nominal terms over the coming three years. Given successive years of high inflation and double-digit growth in nominal GDP, such expenditure growth does not appear excessive.[1],[2]Total provincial government spending – while increasing somewhat in the near term – will remain below 15% of GDP throughout the coming period (Figure 1), a level which remains markedly lower than other parts of Canada.[3]

On the revenue side, higher energy prices and several major projects transitioning into their “post-payout” phase in 2022 resulted in windfall resource revenues, coming in at over $27bn and accounting for over one-third of all revenues in the last fiscal year. Here, too, some commentators have criticized the limited progress made in reducing Alberta’s overreliance on this highly volatile source of income. But, with the provincial government using last year’s surplus to pay down over $13bn of maturing debt and committing to a new fiscal framework, the charges of profligacy appear overdone. Going forward, oil prices are forecast to moderate towards a conservative level of $73-79 per barrel in the coming years, with this having a corresponding negative impact on resource revenues; whereas growth in underlying tax revenues (e.g., personal income tax, corporate income tax) is forecast to remain solid.

To be sure, making progress towards reining-in the non-resource deficit and thus reducing debt levels or making larger contributions to the Alberta Heritage Savings Trust Fund is a laudable policy goal, especially during a period when economic growth will remain solid compared to the rest of Canada. In fact, some of the budget’s most interesting reading stems from the assumptions underpinning the economic forecast for the next three years. Whereas real GDP growth across the rest of Canada is expected to be anaemic at less than 1% in the near term, Alberta is set to see its economy grow by around 3% annually.[4] Stronger growth in Alberta is also forecast to encourage inter-provincial mobility, prompting a rebound in population growth to around 3% this year and alleviating some of the labour shortages that have become pronounced in sectors such as construction, accommodation and food services, and healthcare.[5]

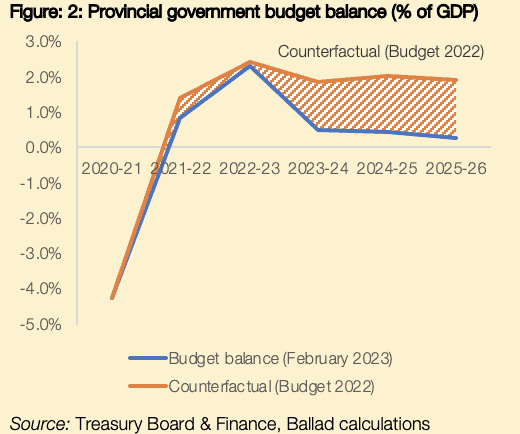

Against this broadly benign backdrop for economic activity and the labour market, the question becomes whether adding stimulus through higher spending is an appropriate policy stance. Again, it is a matter of scale: even with energy prices forecast to decline, the province expects modest budget surpluses in the coming years, albeit falling from $2.4bn (0.5% of GDP) in fiscal year 2023-24 to $1.4bn by fiscal year 2025-26. By contrast, had the provincial government chosen to stick with its spending plans as set out in last year’s budget, these annual surpluses would have been higher by over $7bn on average (1.5% of GDP), a considerable amount.

The use of this fiscal space has been allocated to supporting municipalities which have grappled with weak economic growth and falling property assessments (especially for oil and gas-related properties); helping unemployed Albertans return to work through the Alberta at Work initiative; expanding the provision of healthcare; and allowing for wage increases for public servants, healthcare staff, and teachers. On the capital side, meanwhile, there are large upfront spending increases in areas like municipal transport – albeit mostly for the Edmonton and Calgary transit systems – healthcare infrastructure, and highway upgrades. After rising by almost one-quarter to reach $8bn this fiscal year, capital spending is forecast to moderate towards $7bn thereafter, reflecting the transition to the Local Government Fiscal Framework (LGFF) and reduced capital spending across a range of other policy areas.

Analyzing budgetary numbers while abstracting from the actual programs that they are funding overlooks some important factors. The challenges facing many parts of the public sector in recent years have led to considerable shortfalls in policy delivery: post-secondaries are balancing reduced funding with rising demands, prompting hikes in tuition fees and excluding society’s marginalized cohorts in the process;[6] public safety concerns are heightened across the province, particularly in urban centres; while rural municipalities have had to contend with repeated cuts to infrastructure budgets, all while grappling with their own host of social issues.

According to our estimates, operating expenses have increased by only 1% in real terms since this government assumed office in 2019, despite these additional demands on public services. Furthermore, the current forecasts actually anticipate a renewed decline in both operating and capital expenses in real terms over the coming three fiscal years.[7]

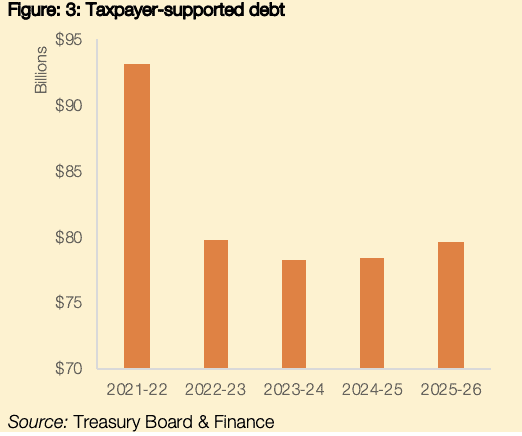

Last week’s budget, then, represents a fairly modest reversal of earlier trends, and our overall interpretation is that a balance has been struck between meeting near-term spending pressures and preserving longer-term sustainability. While there are no guarantees that the spending restraint outlined for future years will be maintained, the introduction of a new fiscal framework further underlines the equanimity with which the province’s finances are being approached, and the determination to keep debt levels in check (Figure 3). This new framework: limits the growth in operations spending to population growth plus inflation; contains the scope for in-year spending increases to the amounts appropriated for contingency purposes; and requires balanced budgets to be achieved and sets out the conditions which have to be met in order to deviate from this, ranging from unanticipated revenue declines to increased spending under the Alberta Petrochemicals Incentive Program (APIP).

Last week’s budget, then, represents a fairly modest reversal of earlier trends, and our overall interpretation is that a balance has been struck between meeting near-term spending pressures and preserving longer-term sustainability. While there are no guarantees that the spending restraint outlined for future years will be maintained, the introduction of a new fiscal framework further underlines the equanimity with which the province’s finances are being approached, and the determination to keep debt levels in check (Figure 3). This new framework: limits the growth in operations spending to population growth plus inflation; contains the scope for in-year spending increases to the amounts appropriated for contingency purposes; and requires balanced budgets to be achieved and sets out the conditions which have to be met in order to deviate from this, ranging from unanticipated revenue declines to increased spending under the Alberta Petrochemicals Incentive Program (APIP).

At first glance, some of the parameters surrounding this new fiscal framework appear cumbersome and could create incentives to “game” the system. Furthermore, the new framework overlooks the question of what Alberta’s public finances should look like over the longer term, including whether the current composition between tax and spending is appropriate given the many economic challenges facing the province. For example, the allowances made for spending increases under APIP belie a continued prioritization of the energy sector, whereas more fundamental changes to the public finances that ensure all sectors have the opportunity to grow would be much more impactful. Such changes could include a comprehensive reform of tax incentives or additional funding for infrastructure, labour market training, R&D funding, or a host of other programs that would raise potential growth.

What this new fiscal framework does instead is sustain the province’s focus on spending control. As we noted earlier, however, operating spending has not changed substantially in real terms during this government’s tenure, suggesting that excessive expenditure growth is not really the fundamental issue facing the Alberta’s finances. Yet, despite Alberta’s tax take being low by many standards, the new framework does not outline similar clauses for ensuring that tax cuts are implemented in a revenue-neutral way. In our view, a more appropriate fiscal anchor for the province to focus on is the non-resource budget balance – i.e., the budget balance when resource revenues are excluded. Here, we find a more sizeable deficit of $16.0bn (-3.5% of GDP), but which is falling to $14.4bn (-2.9%) by the end of the forecast period. The size of the non-resource budget balance is significant, but not grossly out of line with international comparators. In fact, well-regarded models of how to manage resource revenues such as Norway often have much higher non-resource deficits than Alberta, despite having much larger revenue bases due to higher marginal tax rates on incomes and consumption.[8]

Despite the province’s considerable endowment of natural resources, its citizens have relatively little to show for it in terms of a sovereign wealth fund that could be used to generate additional income or invest in infrastructure that would generate better outcomes, both economically and socially. Ultimately, our assessment is that this new fiscal framework does little to change that.

[1] In Alberta’s case, estimates of nominal GDP can be highly volatile given the size of the province’s energy sector and its corresponding weight in GDP deflators (especially export deflators).

[2] Furthermore, spending across non-core policy areas (i.e., those not included in the provision of healthcare, education, or social services) will actually continue falling in nominal terms.

[3] Further reinforcing this finding, operating expenses as a % of GDP will actually fall from 12.5% of GDP this fiscal year (2023-24) to just 12% of GDP by the end of the budget forecast period (2025-26).

[4] For GDP growth comparisons with other Canadian provinces, see RBC’s Provincial Outlook & Fiscal Outlook and TD Bank’s Provincial Economic Outlook.

[5] The budget included specific measures to increase labour supply in healthcare across the province, especially in rural areas.

[6] Enrolments across all of Alberta’s post-secondaries has increased from 263,000 students in the 2017-18 academic year, to 270,000 students in 2021-22. A further breakdown of these figures is available from the Government of Alberta.

[7] Our estimates of real changes in operating expenses are taken from budgetary documents, some of which are difficult to reconcile due to the inconsistent accounting of expenditure items such as “Crude-by-Rail” or “Disaster Assistance”; while we exclude operations spending related to the response to COVID-19, a health crisis that is no longer having such an outsized impact on the economy or government spending.

[8] For example, Norway’s non-oil budget balance was almost 11% of GDP in 2021, while tax revenues were some 42% of GDP.