The conflict in Ukraine is generating significant consequences for the global economy: in the short term, commodity prices have moved sharply higher due to renewed supply chain disruptions and lost output in a key region; while in the long term, Russia’s unilateral actions and coordinated Western sanctions appear to indicate further fragmentation along geopolitical lines. At this stage, the emerging economic landscape encompasses the United States and its liberal democratic partners on one side, opposed by China and its key trading counterparts (including Russia) on the other.

The West’s response to Russian aggression so far has included a phasing out of energy imports, excluding Russian banks from the internal payments architecture (SWIFT), and freezing the central bank’s foreign currency reserves; while a host of private companies have voluntarily withdrawn from the Russian market and several prominent oligarchs have had their assets frozen. The breadth and scale of these measures are significant and underline a fundamental re-evaluation of the West’s relationship with one of the world’s largest economies and a key producer of commodities in energy, metals, and agriculture.[1]

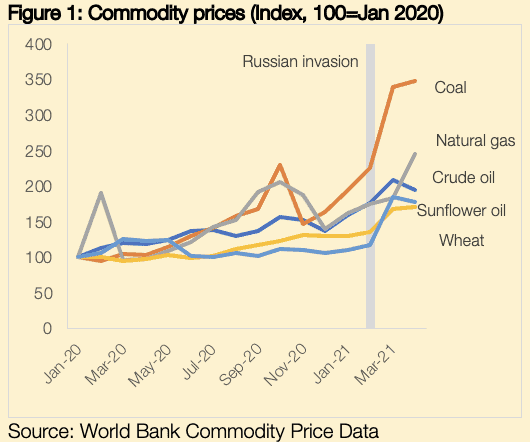

The immediate impact on global markets has been a sharp upward movement in the prices of those commodities (Figure 1), stemming from: (i) the physical impact of the war on Ukrainian transport infrastructure; and (ii) the direct impact of sanctions which limit the supply of Russian goods. Furthermore, the conflict has raised transport and insurance costs for producers across the wider region. This combination has placed renewed upward pressure on headline inflation; the price growth impetus that initially came from the pandemic has rotated to the Ukraine conflict and its geopolitical consequences, aggravated further by droughts and unfavourable weather for crops. This in turn is generating greater urgency across central banks to raise interest rates, while policymakers also rushed to release fuel reserves (e.g., the Strategic Petroleum Reserve), remove certain consumption taxes, and once again shore up supply chains for key industrial and agricultural inputs.

With crude oil above $100 per barrel and natural gas prices at their highest level since 2008, producers can reconsider the viability of previously shelved projects. While there are policy uncertainties surrounding the transition to net zero emissions, Europe’s urgent need for LNG to replace current Russian imports presents Alberta with an opportunity to develop a new market with growing demand.[3]

With crude oil above $100 per barrel and natural gas prices at their highest level since 2008, producers can reconsider the viability of previously shelved projects. While there are policy uncertainties surrounding the transition to net zero emissions, Europe’s urgent need for LNG to replace current Russian imports presents Alberta with an opportunity to develop a new market with growing demand.[3]Such market opportunities, combined with the province’s broader strategies for natural gas and hydrogen production, provide a route towards shifting the energy sector higher up the value chain while remaining competitive. Producing cleaner, high value-added products will remain an imperative policy goal, particularly given that previous oil price shocks have led to permanent demand destruction as consumers reduce consumption, improvements in energy efficiency are found, and new sources of energy are developed (e.g., renewables, fracking technologies). Indeed, a significant part of the European response to phasing-out its energy imports from Russia is a doubling down on support for renewables and bringing forward its climate change commitments.

In Ballad’s view, Europe’s changes to the composition of its trading partners – particularly in its procurement of natural resources – underlines a deeper geopolitical and economic shift taking place, wherein earlier globalization trends are reversing, and trade relationships are being reconfigured on a more regional basis. The repudiation of free trade and capital flows has been building for several years; events such as Brexit, the US-China trade tensions, or the supply chain disruptions caused by the pandemic have all coincided with growing anti-globalization sentiment and calls for re-shoring of production. However, the conflict in Ukraine and the West’s response is one of its most significant manifestations: unprecedented measures such as freezing the Russian central bank’s dollar-denominated assets and committing to reduced Russian energy dependence represent a departure from earlier approaches, while also seeming to illustrate the West’s acquiescence to geopolitical realities.

As noted by Tchakarova (2022), the emerging geopolitical and economic landscape is characterized by: (i) a bifurcation of the global economic and financial system which will include systemic competition between the US and China; and (ii) fluid geopolitical constellations between more regional powers. The early stages of these shifts are already playing out, with the US and UK beginning discussions on Transatlantic trade, while the US’s new procurement guidance requires that infrastructure projects be built with domestic materials.[4] Fragmentation of the global economy along these lines would slow the exchange of technologies and productivity improvements, with reports already emerging that some multinational corporations are shifting their supply chains closer to key markets.

The medium- and long-term consequences of this shift are significant. Several organizations have published estimates of lower global GDP and global trade as a result of sanctions, as well as significant adjustments for industries and labour markets within countries.[5] In theoretical terms, the reason for lower output stems from efficiency losses as countries are no longer producing goods according to their comparative advantage; the pursuit of more autarkic and nationalist economic policies means that labour and capital are not being deployed in their most productive uses.[6] In a world with conflict and geopolitical competition, energy and food security concerns are likely to trump the efficiency and welfare losses that can be anticipated. Even in the absence of conflict, however, the ongoing supply chain disruptions highlight the fragility of pre-pandemic supply chains.

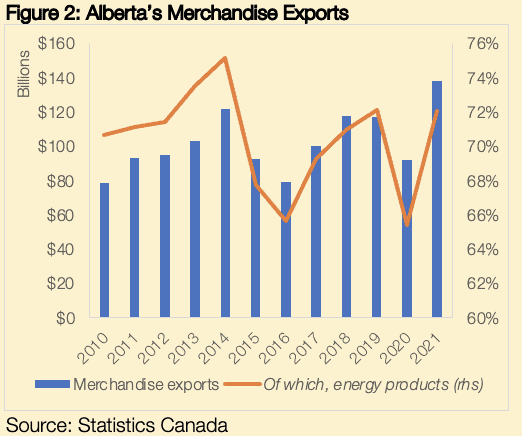

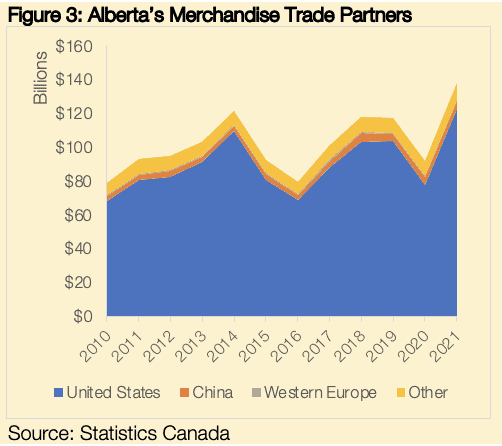

It is difficult to identify in exact terms what these global shifts imply for Alberta. After all, whereas global economic output is unequivocally expected to fall, the specific effects on Alberta’s economy are more ambiguous. For example, higher prices for producers due to less international competition would raise output in those sectors, whereas the loss of access to a large market (e.g., China) would imply losses for those businesses that are most exposed.[7] An overwhelming majority (89%) of Alberta’s merchandise exports go to the US as their first destination, implying that the province’s exposure to other regions is limited. It is clear, then, where Alberta’s economic interests lie on this divide.

Calls for Alberta’s economic diversification grow louder with each downturn in commodity prices. Often, however, what is actually being argued for is an end to the boom-bust cycles that characterize the province’s budget process; unfortunately, Alberta’s often pro-cyclical use of resource revenues provide an example of how not to do it. For the economy more generally, the heavy share of oil and gas extraction reflect its natural endowments and comparative advantage. In a global economy fragmenting along geopolitical lines, recent events in Ukraine seem to augment Alberta’s comparative advantage as one of very few sources of ethically produced energy.

In an economy in which oil and gas accounts for between one-quarter and one-third of annual output, efforts at diversification should be focused on shifting towards higher value-added activities across sectors in which the province enjoys comparative advantage (i.e., the ability to produce at a lower opportunity cost), including energy. The geopolitical and economic shifts that we are anticipating provide the province with a unique opportunity to position itself as the premium source of ethical oil and gas for the West, providing producers and the province with much needed resources in the interim. This time should be well spent to implement labour market and economic reforms that allow the province to capitalize on the advantages it enjoys in other areas too.

The Ballad Auger is written by Senior Research Analyst, Alan Gilligan.

[1] For example, data from KPMG finds that Russia and Ukraine account for 20%of all global wheat production and 70% of sunflower production.

[2] The net gains for producers of agricultural products are less clear given the much higher input costs (e.g., fuel) and the shortages of key inputs (e.g., fertilizers). Their net gains are thus likely to be more limited.

[3] Previous IEA forecasts had expected European natural gas demand to recover to pre-pandemic levels and remain broadly stable thereafter. However, the shifting composition of suppliers – wherein the European Union plans to reduce its dependency on Russian gas by two-thirds this year alone – means that European LNG demand is now forecast to spike by at least 20% in 2022 (WoodMac, 2022).

[4] This has prompted concern among Canadian policymakers seeking to ensure that exports to the US are exempt from these requirements.

[5] In some cases these declines are significant. For example, the World Trade Organization (WTO) previously published its estimates of the impact of a global trade war (WTO, 2019). Compared to the baseline projection global GDP would be around 2% lower and global trade would be 17% lower after just four years. By comparison, global GDP fell about 2.1% and global trade 12.4% in the global financial crisis of 2009, the largest economic shock in recent history.

[6] David Ricardo’s (1817) articulation of comparative advantage and the gains from trade is among the most fundamental concepts in international trade theory. In sum, it finds that as long as there are differences in labour productivity across nations, it follows that there will be gains from trade.

[7] It should be noted that international competition often entails productivity gains for domestic producers. As such, notwithstanding the potential short-term gains from reshoring, a decline in international trade and competition would result in slower productivity growth in the long run.